Zillow’s July Report: A Game-Changer for Savannah Homebuyers?

Is the Housing Market Shifting in Savannah? Here’s What You Need to Know

You might not feel it just yet, but the housing market is shifting gears. According to Zillow’s latest report, July marked a noticeable shift from a strong seller’s market to a more balanced, neutral territory.

So, what does this mean for you, when you’re buying or selling a home in Savannah? Let’s dive into the details.

The Shift to a Neutral Market

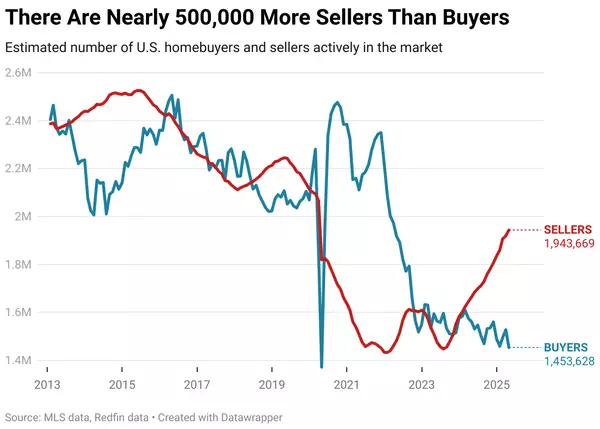

For the first time this year—and the first July since 2019—the national housing market has entered neutral territory. This means that neither buyers nor sellers hold a distinct advantage, a significant change from the red-hot seller’s market we’ve seen in recent years.

In this more balanced market, homes are staying on the market a bit longer. Nationally, the average time for a property to go under contract was 18 days in July. I know what you’re thinking: “That’s still pretty quick!” And you’re right, but it’s nearly a week longer than this time last year.

We’ve also seen a 25% increase in housing inventory compared to 2023, giving buyers more options to choose from. Plus, about 26% of homes on Zillow saw a price reduction in July—the highest percentage for any July since 2018.

Savannah Housing Trends: July 2024

Now that we’ve covered the national trends, let’s zoom in on Savannah’s market.

- Days on Market: On average, homes in Savannah went under contract in 53 days in July, marking a 23% increase compared to last year.

- Active Listings: The number of homes for sale in July rose to 2413, showing a 56% increase year over year.

- Price Reductions: We saw 1076 properties in Savannah reduce their asking prices this July, which is a 3% increase from last year.

What Buyers Should Know

If you’re a buyer in Savannah, this market shift offers you a moment to breathe. With more inventory and homes staying on the market a bit longer, you’ve got the flexibility to make a well-informed decision.

And here’s a tip: Mortgage rates dipped in early August, which might bring more buyers back into the market, sparking some competition. So, keep that in mind as you navigate your home search.

Another key update for buyers: As of August 17, 2024, new industry mandates require buyer’s agents to enter into a written agreement with you before showing any properties. This change is all about transparency in buyer-agent compensation. Learn more about it here, or schedule a call with me and I’ll walk you through it.

What Sellers Should Know

For sellers, there’s no need to panic, but it’s time to adjust expectations. Gone are the days of properties flying off the market in hours. With more inventory available, pricing your home correctly is more critical than ever.

As the market becomes more competitive for sellers, consider sweetening the deal for buyers. Covering some closing costs or offering compensation for the buyer’s agent could make your home stand out. Even though new industry rules mean this compensation can’t be listed on the MLS, you can still offer it off the MLS.

Final Thoughts

Whether you’re buying or selling in Savannah, staying informed and being prepared to adapt is key. The housing market is always in flux, and changes in mortgage rates can influence buyer and seller activity. Don’t hesitate to reach out for personalized market insights or advice tailored to your situation. Let’s chat—schedule a time with me today!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "