What Does Housing Affordability Really Look Like in Georgia?

Spoiler alert: Housing affordability in Savannah isn’t nearly as simple as the headlines want it to be.

Some say it’s about prices. Others say it’s inventory. But really? It’s about access. It’s about options. And it’s about what affordable actually means to working families trying to buy a home right now.

So what does affordability look like here in Savannah? And where are the opportunities hiding?

Let’s break it down.

Do We Have a Housing Shortage—or an Access Problem?

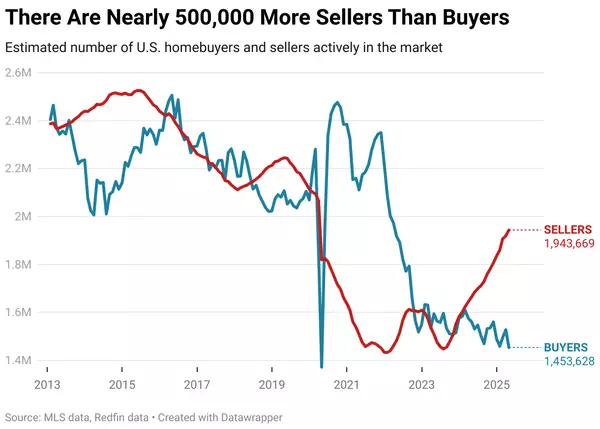

If you’ve been scrolling through housing market headlines, you’ve probably heard the term “inventory crisis.” But depending on who you ask, it’s not that simple.

Take Ivy Zelman—she saw the 2008 crash coming before most people even knew what a subprime loan was. Her take today? It’s not just about how many homes are available. It’s about how many people can actually afford the ones that are.

Put it this way: If the average home in a neighborhood has a $2,500 monthly payment, and the average buyer can only handle $1,800… it doesn’t matter how many homes are listed. They might as well not exist.

Then there’s Logan Mohtashami, another big voice in housing economics. He’s got a blunt message: affordability has always been an issue. Home prices have gone up through inflation, recessions, and everything in between. Waiting for a big drop? That’s not a plan. That’s a fantasy.

So how do people buy homes in a market like this?

They adjust. They combine incomes, open their search to more neighborhoods, and get creative with financing. And yes—it still works.

How Does Georgia Stack Up?

According to Realtor.com’s housing report card:

-

Georgia’s Affordability Score is about average.

-

The median earner spends around 25% of their income on a median-priced home.

-

We’ve got a strong permit-to-population ratio, which means builders are still building.

-

And our new construction premium is relatively low—so buyers aren’t paying huge markups on brand-new homes.

That puts Georgia in the “solid middle” range—better than much of the West and Northeast, but not quite as affordable as parts of the Midwest.

What Affordability Looks Like in Savannah

Now let’s zoom in.

Savannah’s home prices have definitely climbed. But compared to bigger cities, this is still one of the most family-friendly, opportunity-rich markets in the Southeast.

Where are families finding success right now?

-

Effingham and Bryan counties are getting attention thanks to new construction, family-sized homes, and growing school systems.

-

Closer to town, areas like West Chatham and Southside Savannah offer great value if you're willing to be a little flexible on home features or commute time.

-

Builder incentives, rate buydowns, and down payment assistance are making a comeback—and we’ve got access to all of it.

We’re also seeing more clients use creative strategies like:

-

Picking smaller square footage in a better school district

-

Choosing move-in ready homes with seller credits over a "dream renovation"

-

Leveraging low down payment options to stay cash-rich and stress-free

The Bottom Line: Homeownership Is Still Possible

Yes, rates are up. Yes, home prices have grown. But that doesn’t mean you're out of options.

You just need to know where to look and have someone who can help you make sense of it all.

If you're curious about what’s possible in today’s market—or just want to get a clear picture of your options, reach out. I’ll help you figure out the smartest next step for your situation, no pressure, no jargon.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "