Mortgage Rates in 2025: What's Going On and How to Navigate It in Savannah

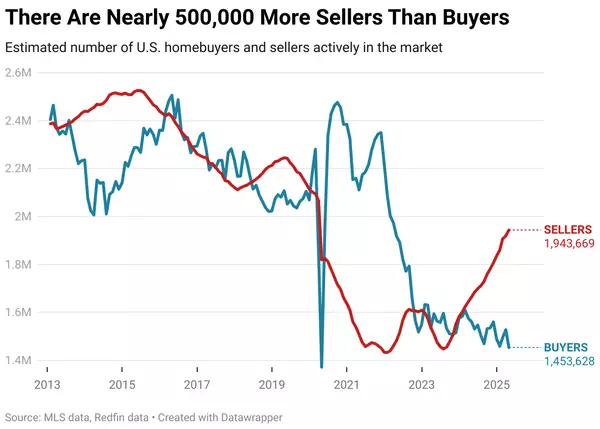

Since the fall, mortgage rates have been on a wild ride. Back in September, they dipped into the low 6% range, only to jump above 7% by the time 2025 rolled around.

Yikes.

If you’re feeling a little stressed out, you’re not alone. Rate fluctuations like this can make the home-buying process feel unpredictable, even intimidating. But here’s the thing—you don’t have to wait for the “perfect” rate to achieve your homeownership dreams.

Savannah buyers are finding opportunities no matter where rates land. With a little insight into what drives mortgage rates and a solid plan, you can feel more confident and prepared to lock in a rate that works for you. Let’s break it down.

What Causes Mortgage Rates to Fluctuate?

Mortgage rates might feel random, but there’s a method to the madness. Rates are influenced by a mix of economic factors, including inflation, Federal Reserve policies, and even global events.

Here’s what you need to know:

- The Federal Reserve: While the Fed doesn’t set mortgage rates directly, it plays a big role. When inflation heats up, the Fed raises interest rates to cool the economy, often driving mortgage rates higher.

- Economic Growth: A booming economy and low unemployment increase demand for loans, which can push rates up. When the economy slows, rates often drop to encourage borrowing.

- Financial Markets: Mortgage rates tend to track the 10-year Treasury yield. If investors get nervous (say, due to global instability), they move money into bonds, lowering yields—and mortgage rates often follow.

- Government Policies: Programs like down payment assistance or tax credits can fuel demand, potentially nudging rates higher.

- Global Events: Wars, pandemics, elections—world events impact the U.S. economy and financial markets, which in turn influence rates.

How to Manage Your Monthly Mortgage Costs

Planning your budget can feel tricky with rates bouncing around, but it’s doable with a little foresight.

- Use an Online Calculator: Plug in different interest rates and down payments to get a clearer picture of what you can afford.

- Think Beyond Principal & Interest: Your monthly payment will also include property taxes, homeowner’s insurance, and possibly PMI (if you’re putting down less than 20%).

- Plan for Flexibility: Budget for a slightly higher rate than expected, so you’re prepared if rates increase before you close.

With careful planning, you’ll be ready for whatever the market throws at you.

5 Ways Savannah Buyers Are Scoring Lower Rates

Believe it or not, buyers are getting creative—and successful—in securing better rates. Zillow reports that 45% of recent buyers locked in rates below 5%. Here’s how:

-

Boost Your Credit Score

A better credit score can save you thousands over the life of your loan. Simple steps like paying down debt, avoiding new credit inquiries, and reporting rent payments can help. -

Consider Buying Points

Mortgage points and rate buydowns are upfront payments to reduce your interest rate. Nearly one-quarter (23%) of buyers who secured a rate under 5% over the past year bought points to do so. When buying a newly built home, builders sometimes cover these costs to attract buyers, but these strategies can work with resale homes, too. Just remember to:

- Assess the break-even point to ensure long-term savings outweigh upfront costs.

- Consult with a loan officer to see if this strategy aligns with your financial goals.

-

Explore Alternative Loan Types

Adjustable-rate mortgages (ARMs) or shorter-term loans may offer lower initial rates. They’re worth considering if you don’t plan to stay in the home long term. -

Look Into Down Payment Assistance

Don’t let a big down payment keep you on the sidelines. Programs are available to help Savannah buyers, and many first-timers are taking advantage. -

Negotiate Incentives

In today’s market, sellers and builders may offer rate buy-downs or cover closing costs to seal the deal. Don’t be afraid to ask—it could save you a bundle.

Final Thoughts: Don’t Wait for the “Perfect” Rate

Yes, rates have been unpredictable, but that doesn’t mean you’re stuck. With the right strategy and guidance, you can make your homeownership goals happen.

If you’re ready to explore your options, give me a call. Let’s work together to navigate today’s market and find the best path for your family. Remember, it’s not about timing the market—it’s about making the best decision for you.

Savannah is home to opportunities for every buyer. Let’s make 2025 the year you find yours.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "