Should You Sell or Stay in 2025?

If you’re a homeowner in Savannah or the surrounding Lowcountry, chances are you’ve noticed your home’s value climb over the past few years. Thanks to record-high equity levels, many local families are sitting on what feels like a financial jackpot. But as we approach 2025, the housing market is shifting, and you might be wondering:

Is now the time to sell my home and cash in on that equity—or should I stay put and make the most of what I’ve got?

Let’s break it down so you can make the smartest move for your situation.

What Is Home Equity (and Why Should You Care)?

Home equity is simple: it’s the difference between what your home is worth and what you still owe on your mortgage. For example, if your Savannah home is valued at $400,000 and you owe $200,000, you’ve got $200,000 in equity.

In Corelogic's Q3 2024 Homeowner Equity Insights Report, they reported that nationwide, homeowners saw their collective equity increase by $425 billion in the past year, bringing total U.S. homeowner equity to a jaw-dropping $17.5 trillion (yes, trillion). Even though the pace of equity growth is slowing for 2025, homeowners here in Savannah can still benefit from historically high equity levels.

This brings us to the big question: What do you do with this financial windfall?

Should You Sell?

Selling your home can be a winning strategy, especially if you want to:

1. Cash In on Equity Gains

Over the last five years, median home prices in the U.S. have climbed nearly 50%. That means if you bought your home before 2019, you’re likely sitting on significant equity. By selling now, you can use that cash to fund a new down payment, pay off debt, or invest in something else that aligns with your financial goals.

2. Downsize or Relocate

Maybe your kids are off to college, or you’re eyeing a move closer to work, family, or the beach. If your current home no longer fits your needs, your equity can help you transition smoothly—whether that’s downsizing to save money or moving to a new neighborhood that’s a better fit for your lifestyle.

3. Get Ahead of Market Changes

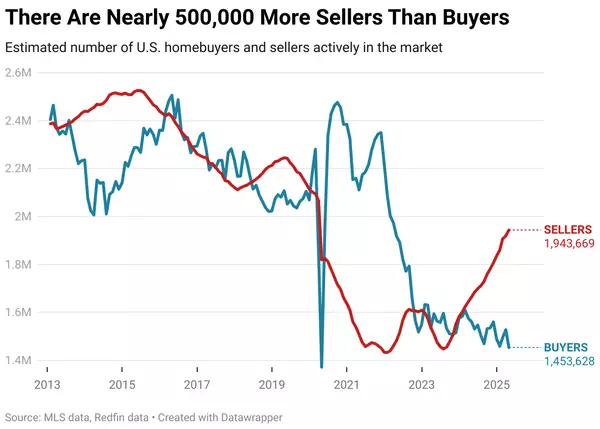

While home prices are expected to grow modestly in 2025 (about 2.3%, according to CoreLogic), rising inventory and regional affordability concerns could slow equity growth in the coming years. Selling now allows you to lock in your gains before the market shifts.

Or Should You Stay?

Staying in your home might make more sense if you:

1. Want to Build More Equity

Even with slower price appreciation expected, Savannah’s housing market remains strong, and steady mortgage payments mean you’ll continue to build equity over time. If you don’t need to sell right away, staying put allows your investment to grow further.

2. Love Your Current Home and Community

Let’s be real—Savannah has a charm that’s hard to leave behind. If you’re happy in your current space and love your neighborhood, staying put and focusing on home improvements or paying down your mortgage can be a great way to enhance your lifestyle and financial future.

What’s Your Best Move?

When deciding whether to sell or stay, ask yourself:

- What are my financial goals? Do you need a lump sum of cash now, or do you prefer to continue building long-term wealth through equity?

- What is the market like in my area? CoreLogic and CBS highlight significant regional differences in equity growth. Research your local market or consult a real estate agent to understand your home’s value.

- What are the costs of moving? Factor in expenses like closing costs, moving fees, and potential higher mortgage rates if you’re buying a new home.

If you’re not sure where to start, let’s talk. Whether you’re looking to sell, buy, or stay put, I’m here to help Savannah families make confident, informed decisions about their homes. Let’s create a game plan that works for you.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "