Savannah Market Update: Balance Is Returning To Real Estate

The Savannah housing market has been moving fast for years. Buyers raced to beat other offers. Sellers enjoyed instant demand. Investors often felt sidelined. But July 2025 delivered a different picture, one that shows balance creeping back into the market. Savannah By The Numbers Here are the key

Read More

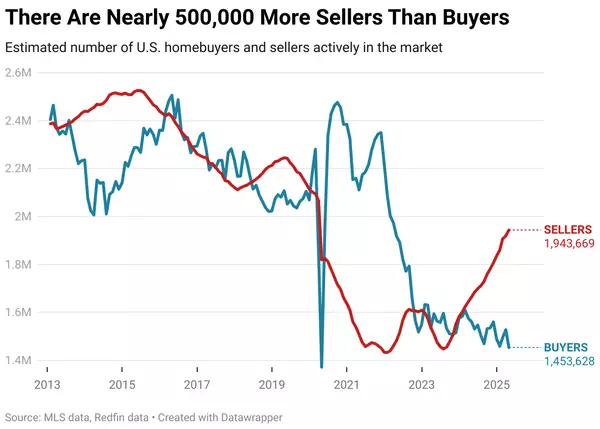

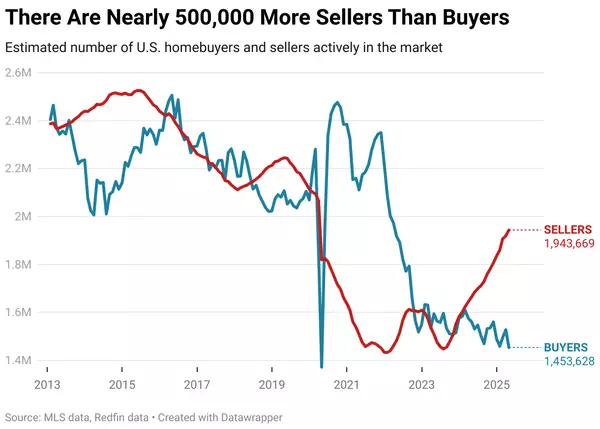

Is Now a Good Time to Buy a Home in 2025? What the Latest Housing Market Data Says

Is Now a Good Time to Buy a Home? The Data Says Yes—If You Can Afford It Every buyer wants to know: “Is now a good time to buy?” And while there’s no one-size-fits-all answer, the national data is showing a noticeable shift—and it could work in favor of today’s buyers. Inventory Is Rising—Fast Acco

Read More

What Does Housing Affordability Really Look Like in Georgia?

Spoiler alert: Housing affordability in Savannah isn’t nearly as simple as the headlines want it to be. Some say it’s about prices. Others say it’s inventory. But really? It’s about access. It’s about options. And it’s about what affordable actually means to working families trying to buy a home rig

Read More

5 Things to Know About the 2025 Savannah Spring Housing Market

The spring housing market is here, and if you’re thinking about buying or selling, you’ve probably heard plenty of predictions, opinions, and advice. Some of it is useful. Some of it? Not so much. So, what’s the real story? Realtor.com’s Chief Economist, Danielle Hale, recently shared advice with he

Read More

Categories

Recent Posts