The 2020s Housing Market and What It Means for Your Investment

The 2020s Housing Market: What’s Happening and What You Need to Know

The 2020s housing market continues to surprise us all. National home prices have skyrocketed over the past four years, surpassing growth seen in entire previous decades. This rapid rise has many wondering – is this sustainable, or are we heading for a correction?

Today, let’s dive into the historical data and see what this means for you.

2020s Home Price Growth: Breaking Records

National home price growth in the early 2020s has already outpaced the total growth seen in both the 1990s and 2010s. According to ResiClub's analysis of the latest data, U.S. home prices have jumped by 47.1% in just the first 50 months of this decade. Even the past year alone has seen significant growth, with U.S. home prices rising 6.4% from February 2023 to February 2024.

Here in Savannah and the surrounding areas, we’re seeing a similar trend. In March 2023, the median home price was $320,318. Fast forward a year, and the median home price is $335,695 marking a 4.5% increase year-over-year.

What Does This Mean for the Rest of the Decade?

To get a clearer picture, let's look at some historical data.

Historical Comparisons

The 2020s surge in home prices can stir up a lot of anxiety, especially with all the doom-and-gloom headlines out there! At the Whalley Group by eXp Realty, we often hear questions like: Does this mean a market crash is coming? Is now a bad time to buy? Should I wait for prices to drop?

Here’s what history tells us: a steady upward trend in home prices each decade.

Check out the national numbers:

- 1990s Decade: +30.1% increase

- 2000s Decade: +47.3% increase

- 2010s Decade: +44.7% increase

- 2020s Decade: +47.1% increase (in just the first 50 months)

So far, the 2020s market is an outlier with higher overall price inflation compared to similar points in previous decades. However, long-term home price appreciation is expected to continue.

What Does This Mean for You?

The historical data suggests a few key takeaways:

-

Long-term Investment: The consistent upward trend across decades highlights the value of real estate as a long-term investment. Even periods of correction are typically followed by recovery and growth, reinforcing real estate’s stability.

-

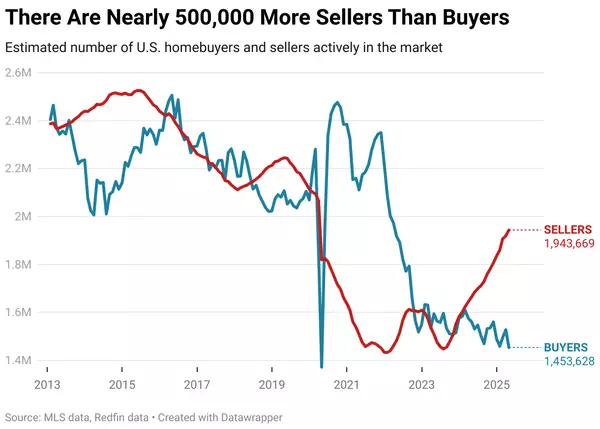

Housing Market Dynamics: Buyers and sellers must stay informed about local market conditions since national trends can mask regional variations. For instance, some markets are currently seeing an increase in housing inventory, while others remain at record lows.

-

Future Outlook: With the market showing no signs of a significant downturn, strategic investments can still yield substantial returns. But, as with any significant purchase, careful analysis is essential.

Interested in current data for Savannah and the surrounding area? Connect with us here. We can help you understand the ins and outs you need to be well informed.

Final Thoughts

We know the current market may seem daunting, but here’s the silver lining: history suggests that real estate remains a solid long-term investment.

However, since national trends can mask regional variations, it’s crucial to stay informed about your local market. Understanding local dynamics—including prime locations, market data, and up-and-coming neighborhoods—is key to leveraging the potential of real estate for long-term gains.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "